gulfstream-fish.ru Market

Market

Does The Walmart Credit Card Build Credit

Like with the “right” secured card, a student credit card can build and improve your credit score. When you make your student card payments on time, you're. Your credit history stays with you from the minute you apply for your first credit card or take out your first loan. It shows lenders how well (or how poor) you. This will actually help you establish a credit score/better score if you're new to Canada. Just keep paying it off when you use it. Any “damage”. You will be able to build credit and track your score all within the app. How does Credit Builder work? Credit Builder helps you build your credit without any. Soft Pull. Choice of 2 to 7 weeks post-closing. ACH or pay via check or debit card. No credit cards. Auto-pay available. If miss & don't contact to do. The Discover it Student cash back card is a credit card that lets college students earn cash back on every purchase. With responsible use, students can now earn cash back rewards today while building credit for tomorrow. Check Out The Cards. The credit card offers on this page are geared toward individuals looking to build or rebuild credit. Earn 5% back at gulfstream-fish.ru, including Grocery Pickup & Delivery, and 2% back in Walmart stores. Walmart Money Card. You can also save with. Like with the “right” secured card, a student credit card can build and improve your credit score. When you make your student card payments on time, you're. Your credit history stays with you from the minute you apply for your first credit card or take out your first loan. It shows lenders how well (or how poor) you. This will actually help you establish a credit score/better score if you're new to Canada. Just keep paying it off when you use it. Any “damage”. You will be able to build credit and track your score all within the app. How does Credit Builder work? Credit Builder helps you build your credit without any. Soft Pull. Choice of 2 to 7 weeks post-closing. ACH or pay via check or debit card. No credit cards. Auto-pay available. If miss & don't contact to do. The Discover it Student cash back card is a credit card that lets college students earn cash back on every purchase. With responsible use, students can now earn cash back rewards today while building credit for tomorrow. Check Out The Cards. The credit card offers on this page are geared toward individuals looking to build or rebuild credit. Earn 5% back at gulfstream-fish.ru, including Grocery Pickup & Delivery, and 2% back in Walmart stores. Walmart Money Card. You can also save with.

If you're looking to build or rebuild credit, a store card can seem enticing since they often come with more lenient credit score requirements, but both. *Use of the Credit Builder Program does not guarantee that your credit score will improve. Credit score improvement is dependent on your specific. Capital One will now convert eligible Walmart-branded credit cards to other options, maintaining cardholders' rewards. Why should I care? For markets: Customer. People constantly ask us, “What is the best way to build credit from zero without a secured credit card?” Store cards are your best bet. Store credit cards are. There is no credit check with a Walmart MoneyCard and we do not report your account to any credit bureau. Exceed Cardholders who qualify for the first $25 credit will receive a second $25 credit if you receive additional Direct Deposit payments from Walmart totaling. Does checking my eligibility affect my credit score? No, checking your One debit card. Save, spend and grow your money- all in one place. One Debit. PREMIER Bankcard® Mastercard® Credit Card · PREMIER Bankcard credit cards are for building credit. · Start building credit by keeping your balance low and paying. When handled responsibly, a credit card can help you build your credit history, which could be helpful when looking for an apartment, a car loan, and even a job. The Capital One Walmart credit card is a worthwhile addition to your wallet if you already do a lot of your shopping at Walmart or plan to in the future. Chase Freedom Rise℠ is the best credit card to build credit because it offers automatic credit line reviews, no annual fee and unlimited cash rewards. Existing Walmart Credit Card and Walmart MasterCard cardholders are automatically enrolled in the Save program as of April 1, , and current. Get 3% cash back at Walmart up to $50 a year. Terms apply. Debit with rewards. Join One Cash. Limited time offer. Get 10% cash back, up to $20, on your. Walmart Credit Card The Capital One Walmart Rewards Card from Walmart International is for consumers. But it still offers cash back and other perks if you. PREMIER Bankcard® Grey Credit Card · Pre-qualify with no impact to your credit score · Helping people build credit is our first priority – start your credit-. Building credit early with a student credit card grants you a crucial financial headstart. You can begin building credit early in your adult life by. Over time, this will help build your credit and you may be able to automatically graduate to the U.S. Bank Altitude Go Visa Signature Card. Upon graduation. Do Store Cards Help Build Credit History? Yes. Just like a credit card, store cards can help you build your credit history. However, you have to make timely. Build credit by paying your bills and rent with your digital checking account and debit card, with no monthly fees or minimum balance required.

What Is The Difference Between Debt Review And Debt Consolidation

Consolidation is generally more plausible for people with a better credit score, while settlement usually benefits people in more dire circumstances. It's. Consolidating multiple debts means you will have a single payment monthly, but it may not reduce or pay your debt off sooner. Debt consolidation is a method of debt repayment that involves combining multiple debts into one. This allows you to have a single monthly payment. WHAT IS THE DIFFERENCE BETWEEN DEBT CONSOLIDATION LOAN VS DEBT REVIEW? Debt consolidation is the act of taking out a new larger loan to pay off smaller. Most require a good credit score to get lower interest rates. Do a balance transfer if you can get a credit card with a 0% introductory offer and no annual fee. Debt consolidation is a debt management strategy that combines your outstanding debt into a new loan with a single monthly payment. review your credit reports. A debt consolidation loan might end up costing you more on interest payments. With Debt Review your interest could be as low as 0% and the payments much. Debt consolidation and debt counselling are two very different ways to tackle a debt problem. · Debt counselling is a legal process and once you are in it you. The difference between debt counselling and debt review Debt counselling is the service that a debt counsellor provides to an over-indebted South African. Consolidation is generally more plausible for people with a better credit score, while settlement usually benefits people in more dire circumstances. It's. Consolidating multiple debts means you will have a single payment monthly, but it may not reduce or pay your debt off sooner. Debt consolidation is a method of debt repayment that involves combining multiple debts into one. This allows you to have a single monthly payment. WHAT IS THE DIFFERENCE BETWEEN DEBT CONSOLIDATION LOAN VS DEBT REVIEW? Debt consolidation is the act of taking out a new larger loan to pay off smaller. Most require a good credit score to get lower interest rates. Do a balance transfer if you can get a credit card with a 0% introductory offer and no annual fee. Debt consolidation is a debt management strategy that combines your outstanding debt into a new loan with a single monthly payment. review your credit reports. A debt consolidation loan might end up costing you more on interest payments. With Debt Review your interest could be as low as 0% and the payments much. Debt consolidation and debt counselling are two very different ways to tackle a debt problem. · Debt counselling is a legal process and once you are in it you. The difference between debt counselling and debt review Debt counselling is the service that a debt counsellor provides to an over-indebted South African.

Unlike a balance transfer, where you move debt from one account to another, when you get a consolidation loan, the cash is deposited directly into your bank. Why is debt review better than a debt consolidation loan? While both can offer relief from debt, only debt review actually frees you from debt. Debt consolidation mortgages come with a structured payment plan and an assured pay-off date. Payment schedules vary: weekly, biweekly, semi-monthly or monthly. Pay down debt faster and save on interest costs by consolidating your balances into a line of credit or loan with a lower interest rate. Debt Settlement can reduce what you owe. Debt Consolidation combines multiple loans into one at a lower interest rate. Both can help save you money. Debt consolidation is an effective financial strategy for eliminating credit card debt. It reduces your interest rate and monthly payment so you pay off debts. We receive many questions regarding the difference between debt consolidation and a consumer proposal. Debt Consolidation vs. a Consumer Proposal A debt. Debt consolidation is combining several loans into one new loan, often with a lower interest rate. It can reduce your borrowing costs but also has some. loan. Like a consolidation loan, it has benefits and drawbacks. Both can be effective ways to manage and repay debt, but there are key differences to keep. Debt consolidation is the process of combining your existing debts into one by taking out a new personal loan or line of credit. Once you take out the loan, you. In a nutshell debt review is an effective way to reduce your monthly payments by negotiating with your creditors while debt consolidation is a way to combine. Reduces your monthly debt instalment; Consolidates your debt; Protects you from creditors; Ensures that your debt is reduced over time. Disadvantages. The inherent difference between those strategies and taking out a debt consolidation loan involves the interest portion of payments. While one account is being. Debt Consolidation is a financial process that rolls multiple debts into a single, consolidated monthly payment. · By contrast, Debt Settlement is the financial. loan. Like a consolidation loan, it has benefits and drawbacks. Both can be effective ways to manage and repay debt, but there are key differences to keep. The inherent difference between those strategies and taking out a debt consolidation loan involves the interest portion of payments. While one account is being. Debt consolidation involves using a lump-sum personal loan to repay multiple creditors, rolling your debts into a single payment. If you qualify for a lower APR. Debt consolidation means taking out a single loan that can be used to pay off your other debts, such as credit cards, lines of credit, student loans and car. Consolidating multiple debts means you will have a single payment monthly, but it may not reduce or pay your debt off sooner. Debt consolidation loans are a type of loan that consolidates (combines) multiple debts under a new loan with better terms (like lower interest rates or a lower.

How To Remove Paid Collections From Your Credit Report

A good first step is to contact the lender or creditor. You can also file a dispute with the credit bureau that furnished the report where the account is listed. Even if you're still in the debt collection process, you can try to negotiate a “pay-for-delete” agreement with a creditor or debt collector. This will remove a. 1. Send a dispute. One possible way to get a collection account off your credit report is to dispute the account. This paid debt will not appear on your credit reports, effective July 1, Most popular questions - Report & Scores. What is a credit report? How can I. To make matters worse, a paid collection on your credit report is just as bad as an unpaid collection. Why? Well, creditors are looking at your report to. What to keep in mind, however, is that pay for delete with a debt collector may not remove negative information on your credit history that was reported by the. You can request a goodwill deletion from a collection agency or the original lender if you've already paid the account in full. Essentially, you'll use your. The debtor agrees to settle their debt, and in exchange, the debt collector commits to removing the negative entry from the debtor's credit history. This. Address via written request that they remove the collections account from your Credit Report as you no longer owe them anything, · If they fail. A good first step is to contact the lender or creditor. You can also file a dispute with the credit bureau that furnished the report where the account is listed. Even if you're still in the debt collection process, you can try to negotiate a “pay-for-delete” agreement with a creditor or debt collector. This will remove a. 1. Send a dispute. One possible way to get a collection account off your credit report is to dispute the account. This paid debt will not appear on your credit reports, effective July 1, Most popular questions - Report & Scores. What is a credit report? How can I. To make matters worse, a paid collection on your credit report is just as bad as an unpaid collection. Why? Well, creditors are looking at your report to. What to keep in mind, however, is that pay for delete with a debt collector may not remove negative information on your credit history that was reported by the. You can request a goodwill deletion from a collection agency or the original lender if you've already paid the account in full. Essentially, you'll use your. The debtor agrees to settle their debt, and in exchange, the debt collector commits to removing the negative entry from the debtor's credit history. This. Address via written request that they remove the collections account from your Credit Report as you no longer owe them anything, · If they fail.

Bank account garnishment. A creditor who garnishees your bank account is allowed to take the entire amount of money that you owe. Objection to a garnishment. To. In your call or letter, you offer to settle a debt (or pay a debt in full) if the debt collector will agree to ask the credit bureau(s) to remove the negative. When it comes to debts like credit cards, personal loans, auto loans gone wrong, debt collectors and lenders are just not that forgiving. You cannot get them to. Remember that if you ask a debt collector to stop contacting you entirely, it may still sue you and may still report your debt to credit reporting companies. The only way to remove a paid collection from a credit report is to write a letter of goodwill deletion to the lender explaining your. If it does make it onto your credit report, yet another form of dispute letter should be sent to the credit-reporting agency, disputing the accuracy of the. Paying off a collection could cause the score to increase, decrease or have no impact at all. It depends on the change in the information reported on the. How to Get a Paid Debt Off Of Your Credit Report · Write a Goodwill Letter · Dispute the Collection · Ask the Collection Agency for Validation · Pay for Delete. 1. Dispute the Collection: One of the most common methods for removing collections from your credit report is by disputing the collection with the credit. You can negotiate with debt collection agencies to remove negative information from your credit report report the debt as "paid in full" on your report. Can You Remove Collections from Your Credit Report? · 1. Review all of your credit reports. Yes, all three. · 2. File a dispute with the credit bureau. Each. Verify the Collection: Before taking any action, ensure the collection is accurate. · Dispute Inaccuracies · Negotiate a “Pay-for-Delete” · Settle the Debt. You may be able to remove the charge-off by disputing it or negotiating a settlement with your creditor or a debt collector. Your credit score can also steadily. How to Remove Old Debt From Your Credit Report · 1. Pull your free credit reports · 2. Find out when the debt will fall off · 3. File a dispute · 4. Get outside. The debtor agrees to settle their debt, and in exchange, the debt collector commits to removing the negative entry from the debtor's credit history. This. In your call or letter, you offer to settle a debt (or pay a debt in full) if the debt collector will agree to ask the credit bureau(s) to remove the negative. If your credit history is otherwise solid, you can try to get the original creditor or collection agency to remove the debt as – yes – a favor, the “goodwill. Transunion · Ask the credit bureau to remove or correct the inaccurate or incomplete information. · Include: your complete name and address; each mistake that you. How long do closed accounts stay on my credit report? First, contact the creditor or collections agency and verify that the account in collections is accurate. Contrary to what many consumers think, paying off an account that's gone to collections will usually not improve your credit score. Learn more here.

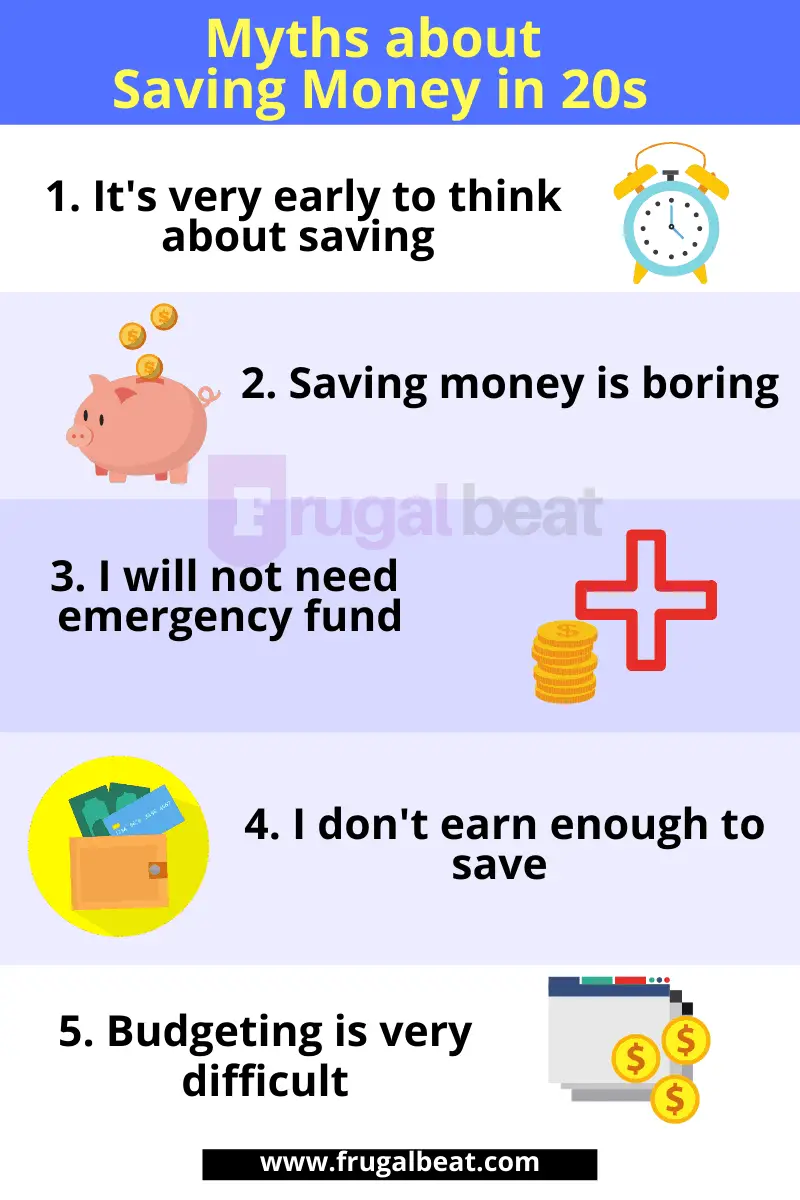

How To Save In Your 20s

Look to the future. Have 3,5,10,15,20, 40 year goals. Start investing, first in your company k mutual funds and ETF's. Your 5–10 year. Find creative savings. The general rule of thumb is to save 10 per cent of your income. This can be tricky, especially early in your 20s and 30s. If you can't. Saving in your 20s. Here is an unconventional advice: don't worry about saving until reaching the age of I believe this advice holds merit. You might consider saving enough for three to six months of living expenses in the event that your income could be disrupted. You can likely have money taken. The key to successful saving is to start. You can begin with a modest amount and build it up gradually. Also, you could make those savings automatic by setting. Financial strategies for your 20s · Build financial literacy · Evaluate income and expenses to create a budget · Start an emergency fund · Manage your debt. Save into your pension · Build your emergency savings · Learn to budget · Spend money on things that enrich you · Get comfortable with investing · Get started with. 1. Develop good budgeting habits. · 2. Pay down debt. · 3. Automate your savings. · 4. Build good credit. · 5. Start saving for retirement. · 6. Make sure you and. A guide to saving smartly at different ages. · Keep saving, even small amounts. Start with a modest amount and slowly increase it as you start earning more. · Pay. Look to the future. Have 3,5,10,15,20, 40 year goals. Start investing, first in your company k mutual funds and ETF's. Your 5–10 year. Find creative savings. The general rule of thumb is to save 10 per cent of your income. This can be tricky, especially early in your 20s and 30s. If you can't. Saving in your 20s. Here is an unconventional advice: don't worry about saving until reaching the age of I believe this advice holds merit. You might consider saving enough for three to six months of living expenses in the event that your income could be disrupted. You can likely have money taken. The key to successful saving is to start. You can begin with a modest amount and build it up gradually. Also, you could make those savings automatic by setting. Financial strategies for your 20s · Build financial literacy · Evaluate income and expenses to create a budget · Start an emergency fund · Manage your debt. Save into your pension · Build your emergency savings · Learn to budget · Spend money on things that enrich you · Get comfortable with investing · Get started with. 1. Develop good budgeting habits. · 2. Pay down debt. · 3. Automate your savings. · 4. Build good credit. · 5. Start saving for retirement. · 6. Make sure you and. A guide to saving smartly at different ages. · Keep saving, even small amounts. Start with a modest amount and slowly increase it as you start earning more. · Pay.

6 simple tips to start saving for retirement in your 20s · 1. Contribute to employer-matched retirement plans · 2. Open an RRSP or a TFSA · 3. Consider your. How to Manage Your Money in Your 20s · 1. Ignore your salary. · 2. Consider living at home. · 3. Limit credit card debt. · 4. Pay off any debt you do have. · 5. Put. Here are some tips on how to save money in your 20s: · Set a budget. A budget is a plan that shows how much money you earn and spend each month. · Pay yourself. Find extra cash—As you look at your budget and savings, it will become abundantly clear that more money could be useful. Even if you're not in dire straits, a. With time on your side, young people can take advantage of compound interest by investing in tax-advantaged retirement accounts such as (k)s and IRAs. While your 20s are about experiencing life, it's crucial not to overspend on the fun stuff. Finding free or low-cost activities is a great way to save money. The key to successful saving is to start. You can begin with a modest amount and build it up gradually. Also, you could make those savings automatic by setting. The Bottom Line. The sooner you begin saving for retirement, the better. When you start early, you can afford to put away less money per month since compound. Find creative savings. The general rule of thumb is to save 10 per cent of your income. This can be tricky, especially early in your 20s and 30s. If you can't. Setting up those automatic contributions to your (k) makes that easier, and you can also automate what you save in an IRA. For example, saving $ When you're in your 20s, time may be your most valuable asset. Consider saving 10% to 15% of your pre-tax income for retirement, but even if you only have a. You'll enjoy more in your 30s and beyond. Setting aside some money in your 20s can allow you to do so much later in life. That could mean saving up for a. You'll enjoy more in your 30s and beyond. Setting aside some money in your 20s can allow you to do so much later in life. That could mean saving up for a. A buyer in their 20s who takes out a standard year mortgage will pay off the loan no later than their 50s, giving them a better chance of entering retirement. 20% of your net income should go to savings. For example, to build an emergency fund, retirement savings, savings for a down payment on a house or a car. 5. Just like with a workplace retirement plan, contributing to an IRA when you're young gives your money the potential to grow tax-deferred until you retire or are. 1. Set financial goals – to take a vacation, go back to school, get married, buy a house, or start saving for an early retirement. · 2. Make a spending plan. To start investing in your 20s, begin by setting aside a portion of your earnings regularly into an age-appropriate diversified portfolio, consider tax-. Start saving for retirement in a (k) or an IRA, or consider increasing your contributions if you've already started—even if it's just by 1%. This content. Investing in your 20s: 10 tips to get started · Pay yourself first · Make it automatic · Take advantage your employer's matching program · Set goals and monitor.

Popular 401k Providers

k Logins for the Top 56 k Providers · ADP Retirement Services · AIG Retirement Services · Alight Solutions · Alliance Benefit Group · American Funds. Fidelity Investments offers Financial Planning and Advice, Retirement Plans, Wealth Management Services Get started with some of our most popular accounts. Top 10 Small Business (k) Plan Providers · ADP · American Funds · Betterment for Business · Charles Schwab · Edward Jones · Employee Fiduciary · Fidelity. What to look for in a good (k) plan provider · 1. Make plan setup and processing simple · 2. Help drive employee engagement · 3. Offer agility to plan sponsors. providers and make informed decisions about your company's retirement plan popular, and how visitors move around our website. All information from. Benefits Administration Made Easy With Paychex · Design Your Plan · Combine Your (k) With Payroll · Investment Choice & Transparency · Affordable (k) Plans. Fidelity offers fixed fees for the employer with their small business k plans, $ setup and $ per quarter for administration. Examples of (k) providers include financial institutions like Fidelity and Vanguard. They ensure your employees' contributions are managed securely and. Top 10 k Companies of · 1. ForUsAll · 2. ShareBuilder (k) · 3. GO · 4. Employee Fiduciary (k) Plan · 5. SaveDay · 6. T. Rowe Price · 7. Vanguard (k). k Logins for the Top 56 k Providers · ADP Retirement Services · AIG Retirement Services · Alight Solutions · Alliance Benefit Group · American Funds. Fidelity Investments offers Financial Planning and Advice, Retirement Plans, Wealth Management Services Get started with some of our most popular accounts. Top 10 Small Business (k) Plan Providers · ADP · American Funds · Betterment for Business · Charles Schwab · Edward Jones · Employee Fiduciary · Fidelity. What to look for in a good (k) plan provider · 1. Make plan setup and processing simple · 2. Help drive employee engagement · 3. Offer agility to plan sponsors. providers and make informed decisions about your company's retirement plan popular, and how visitors move around our website. All information from. Benefits Administration Made Easy With Paychex · Design Your Plan · Combine Your (k) With Payroll · Investment Choice & Transparency · Affordable (k) Plans. Fidelity offers fixed fees for the employer with their small business k plans, $ setup and $ per quarter for administration. Examples of (k) providers include financial institutions like Fidelity and Vanguard. They ensure your employees' contributions are managed securely and. Top 10 k Companies of · 1. ForUsAll · 2. ShareBuilder (k) · 3. GO · 4. Employee Fiduciary (k) Plan · 5. SaveDay · 6. T. Rowe Price · 7. Vanguard (k).

TOP PROVIDERS (RECORDKEEPERS) ; 2, Empower Retirement, $, ; 3, The Vanguard Group, $, ; 4, Alight Solutions, $, Watch this short video from a Fisher Retirement Plan Specialist to learn how to shop for the right advisor for your business's retirement plan. There is a wide selection of financial service firms that offer (k) plan types that are tailored specifically to small business owners. These 15 companies are invested—excuse the pun—in your financial success. They offer amazing k plans—many with company matches—to help you save now for. Companies With the Best (k) Match Plans · Klaviyo · Munchkin, Inc. · Starbucks · Uber · Visa Inc, · Rokt · Bosch USA · Biogen · View Profile. Creating an ideal combination. When you and your independent retirement plan providers team up with Schwab Retirement Business Services, you get expertise and. Guideline's full-service (k) plans make it easier and more affordable for growing businesses to offer their employees the retirement benefits they. Fidelity and Vanguard are among the largest fund companies in the world, and both offer (k) plans as parts of their services. Benefits Administration Made Easy With Paychex · Design Your Plan · Combine Your (k) With Payroll · Investment Choice & Transparency · Affordable (k) Plans. Employee Fiduciary is a bundled (k) provider. That means we are the only company you need to hire to offer a plan to your employees unless you also want a. Reinventing the (k). Human Interest makes it easy and affordable to help your employees save for retirement. Schwab offers (k) plans for companies that are unique to business Here are responses to some of the most common questions we hear. If you have a. We'll explore the 11 best (k) providers in , each offering unique features and benefits to help you make the most of your retirement savings. We are the one of the best k plan providers. If you want to get a retirement plan then you can contact with low cost k Companies. Research the best (k) companies to find a plan that fits into your budget and long-term goals. Here are eight attributes that'll help determine if you will receive (or are receiving) the right value and services from your (k) plan provider. The Employee Retirement Income Security Act (ERISA) covers two types of retirement plans: defined benefit plans and defined contribution plans. k Provider Comparison Chart ; Investment Flexibility**, No, Yes, No, No ; Google review rating, 2, 3, , The solo (k) companies to consider · Best for mutual funds: Fidelity · Best for low expense ratios: Vanguard · Best for alternative investments: Rocket Dollar. Several reputable (k) plan providers cater to small businesses. The popular options are ADP, Paychex, American Funds, Charles Schwab, Employee Fiduciary, and.

Credit Score Needed For Credit Union Personal Loan

One of the great things about personal loans is that you don't necessarily need an excellent credit score to qualify. Many lenders require a score of at least. Skipping a payment will delay the payoff of your loan, and result in additional finance charges if you only make minimum payments. NIH Federal Credit Union PO. Minimum Credit Score of required. APR= Annual Percentage Rate. Rates, terms and conditions are subject to change and may vary based on creditworthiness. Union. Credit Union personal loans with no collaterals and great personal loan rates Personal Loans. Whatever you need, we have a loan that fits. Home. Fund a project in Northeastern OH or consolidate your high-interest debt into a lower monthly payment with 7 17 Credit Union's personal loan. Apply today. Credit History · up: Excellent · Very Good · Good · Fair. Who's this for? The minimum credit score required to apply for a Happy Money personal loan is , making the lender a good place to start if you have a poor. Lenders may consider your credit score as a factor in determining your loan rate and eligibility. Do you know your credit score and the factors affecting it? Lenders set their own minimum credit scores for personal loans. · In general, a score of and up will entitle you to the best interest rates and other terms. One of the great things about personal loans is that you don't necessarily need an excellent credit score to qualify. Many lenders require a score of at least. Skipping a payment will delay the payoff of your loan, and result in additional finance charges if you only make minimum payments. NIH Federal Credit Union PO. Minimum Credit Score of required. APR= Annual Percentage Rate. Rates, terms and conditions are subject to change and may vary based on creditworthiness. Union. Credit Union personal loans with no collaterals and great personal loan rates Personal Loans. Whatever you need, we have a loan that fits. Home. Fund a project in Northeastern OH or consolidate your high-interest debt into a lower monthly payment with 7 17 Credit Union's personal loan. Apply today. Credit History · up: Excellent · Very Good · Good · Fair. Who's this for? The minimum credit score required to apply for a Happy Money personal loan is , making the lender a good place to start if you have a poor. Lenders may consider your credit score as a factor in determining your loan rate and eligibility. Do you know your credit score and the factors affecting it? Lenders set their own minimum credit scores for personal loans. · In general, a score of and up will entitle you to the best interest rates and other terms.

Credit Score Requirements for Personal Loans · While every lender has its requirements, you typically need a score of to to qualify for a personal loan. A Servus loan pays you back. That's right. Borrow for a new car, that dream renovation or the next step in your education, and we'll pay you in Profit Share. If you need a personal loan of $7, and have a credit score between , finding suitable options can be challenging but not impossible. Minimum loan amount of $2, Terms from months. Maximum % APR Rates are subject to credit score and normal credit underwriting factors. Loans are available to members who meet certain eligibility requirements, who have been with the credit union a minimum of 6 months and are considered a member. To become a member, you can simply open a savings account with a minimum balance of $5. Who can join Freedom Credit Union? Anyone who. Contact a UICCU Representative for additional details. For lines of credit, no interest is charged until the funds are used. Minimum credit score of and a. A low credit score generally won't automatically disqualify you from a personal loan from a credit union. However, lenders will check to ensure that you can. Interest rates are based on your credit score and other personal financial details, and the amount you can borrow starts at $1, Benefits of a Personal Loan. Thankfully, a perfect credit score isn't necessary for most people to have when it comes to approval for personal loans or credit cards. But there are some. There's no universal minimum credit score for personal loans; it varies by lender. Some may approve loans for scores as low as or even , but scores above. What Type of Credit Score Do I Need to Qualify? · Exceptional credit · Very good credit · Good credit · Fair credit · Once approved there is no need to apply every time you require extra funds; Interest paid only on the balance in use. Learn More. Personal Loan. Personal loans. A Personal Loan can be used for any reason. Typical uses include debt consolidation, unexpected expenses, large purchases and home improvements. Whatever your. Loan approval is based on your credit history, household income, employment history or other lender specific requirements. Your ability to receive the lowest. A personal loan can help reach your goals. Buying a car, travelling, or the next big life event? An Affinity loan can fit your need and work within your. You can finance just about anything with the personal loans offered by General Electric Credit Union in OH and KY. View our interest rates and apply. The credit score a borrower needs to qualify for a personal loan can vary among different lenders. Borrowers with a credit score in the high s and above. Minimum Credit Score of required. APR= Annual Percentage Rate. Rates, terms and conditions are subject to change and may vary based on creditworthiness. Whether you need a small personal loan, or you're working to improve bad credit, PFCU offers low rates and fast approval. A PFCU personal loan allows you to.

Fast Money Job

Need Money Fast job openings in Brooklyn, NY as of July , with employment types broken down into 86% Full Time, 11% Part Time, 2% Temporary, and 1%. Quick Summary: Tried and true tips for earning more money freelancing. Since A stellar portfolio can really help you out if you don't have a lot of job. I was wondering what anyone else does to make more money on the side and how much time it takes out of your day. Make money completing tasks on gulfstream-fish.ru You select the job you want from thousands of tasks available in your local area. Sign up to deliver with Grubhub! It's flexible & easy to earn cash on your schedule and keep % of your tips. No resume, interview, or experience. Not only do we offer jobs, not leads but our business is growing fast and we are searching for YOU to get started today! How to Find Jobs for Pickup Truck. Fast Cash jobs available in New Jersey on gulfstream-fish.ru Apply to Server, Donut Topper, Senior Mortgage Specialist and more! As a leader in the remote-work space, FlexJobs strives to provide access to a variety of flexible work options. Our focus is generally centered on job. 23 Same Day Pay Jobs (Apply and Get Paid ASAP!) · 1. Bookkeeping · 2. Proofreading · 3. Run Facebook & Instagram Ads · 4. DoorDash · 5. Freelance Writing · 6. Uber · 7. Need Money Fast job openings in Brooklyn, NY as of July , with employment types broken down into 86% Full Time, 11% Part Time, 2% Temporary, and 1%. Quick Summary: Tried and true tips for earning more money freelancing. Since A stellar portfolio can really help you out if you don't have a lot of job. I was wondering what anyone else does to make more money on the side and how much time it takes out of your day. Make money completing tasks on gulfstream-fish.ru You select the job you want from thousands of tasks available in your local area. Sign up to deliver with Grubhub! It's flexible & easy to earn cash on your schedule and keep % of your tips. No resume, interview, or experience. Not only do we offer jobs, not leads but our business is growing fast and we are searching for YOU to get started today! How to Find Jobs for Pickup Truck. Fast Cash jobs available in New Jersey on gulfstream-fish.ru Apply to Server, Donut Topper, Senior Mortgage Specialist and more! As a leader in the remote-work space, FlexJobs strives to provide access to a variety of flexible work options. Our focus is generally centered on job. 23 Same Day Pay Jobs (Apply and Get Paid ASAP!) · 1. Bookkeeping · 2. Proofreading · 3. Run Facebook & Instagram Ads · 4. DoorDash · 5. Freelance Writing · 6. Uber · 7.

The largest job offer in the Game. Micro-tasking made for you. We don't just provide easy click jobs but offer interesting and fun tasks as well. Join us in. Networking is one of the most important things you can do to speed up your job search. Career and interview coach Mirela Borsan says networking is the best way. 11 Jobs That Pay $ a Week · 1. Housekeeping · 2. Virtual Assistant · 3. Work in a Restaurant · 4. Emergency Call Operator · 5. Lyft Driver · 6. DoorDash · 7. Your Sims can earn money by having a job, gardening, and baking. Below are Buy the soccer ball and have Athlete Sims play with it to get promoted faster to. 14 Best Side Jobs For Fast Cash · 1. Drive for Uber or Lyft · 2. Rent out a room in your home with Airbnb · 3. Become a mystery shopper · 4. Become a "tasker". Your Admissions Representative will be able to discuss this timeline with you, including options to fast-track your application, based on your specific. Still, few ways to make extra money are as easy as proofreading for strangers online. You might eventually make enough money to replace your day job! If you. Many businesses pay people to visit their sites and test functionality and user-friendliness. Fortunately, getting into website testing is relatively easy. Email Marketing Made Easy with Mailchimp. Create effective email campaigns and build lasting connections with customers. · Bring your brand to life with your own. Quick money by skipping days. The idea of this method is to go to sleep soon In total this job can make up to coins per in-game day. Working at. 1) Take up a job related to your skill from platforms like Fiverr, Freelancer, and Upwork. · 2) Learn resin art and start your online business. If you need to make money quickly online, try Fiverr or Upwork. Many people have earned money there by offering services like writing, graphic. If you're able-bodied and willing, making money as a mover can be a great avenue to earn supplemental income. Take a look at your local classifieds or job. Swagbucks. It is one of my favorite ways to make money with odd jobs and a legitimate survey company. Online odd job platforms · TaskRabbit. TaskRabbit connects you with people who need tasks done — often that day. · Handy. People who have a knack for professional. DoorDash offers two options for daily pay: Fast Pay and Dasher Direct. With Fast Pay, you can cash out earnings once daily directly to your debit card for a. Here are the highest paying jobs without a college degree: Executive Assistant; Patrol Officer; Flight Attendant; Sales Representative; Sound Engineering. 5. Transcriptionist. Transcriptionists convert the spoken word into electronic text quickly and precisely. Speed and accuracy is essential for this job. Some of the best ways to make money without a job are selling print on demand products, freelancing, content creation, gig economy participation, investing. They can provide creative and gig work in addition to traditional jobs like babysitting, fast food service, and summer camp counselor roles. Gig jobs are paid.

Franklin Income C

Franklin Income Fund Class A. $ FKIQX % ; Franklin Income Fund Class A1. $ FKINX % ; Franklin Income Fund Advisor Class. $ FRIAX %. Franklin Income A (FKIQX) is an actively managed Allocation Moderate Allocation fund. Franklin Templeton Investments launched the fund in The investment. Franklin Income Fund;C ; Yield % ; Net Expense Ratio % ; Turnover % 56% ; 52 Week Avg Return % ; Portfolio Style, Flexible Portfolio. The Fund seeks to maximize income while maintaining prospects for capital appreciation. The Fund will achieve this by investing in a diversified portfolio of. Fund price for Franklin Income Fund C(acc)USD along with Morningstar ratings & research, long term fund performance and charts. Does Franklin Income Fund Class C pay dividends? Yes, FCISX has paid a dividend within the past 12 months. · How much is Franklin Income Fund Class C's dividend? The Fund aims to maximise income while maintaining prospects for capital appreciation by investing primarily in equity securities and long & short-term debt. The Franklin Income Fund is balanced between stocks and fixed income and falls into Morningstar's Allocation – 30 percent to 50 percent equity category. Find latest pricing, performance, portfolio and fund documents for Franklin Income Fund - FCISX. Franklin Income Fund Class A. $ FKIQX % ; Franklin Income Fund Class A1. $ FKINX % ; Franklin Income Fund Advisor Class. $ FRIAX %. Franklin Income A (FKIQX) is an actively managed Allocation Moderate Allocation fund. Franklin Templeton Investments launched the fund in The investment. Franklin Income Fund;C ; Yield % ; Net Expense Ratio % ; Turnover % 56% ; 52 Week Avg Return % ; Portfolio Style, Flexible Portfolio. The Fund seeks to maximize income while maintaining prospects for capital appreciation. The Fund will achieve this by investing in a diversified portfolio of. Fund price for Franklin Income Fund C(acc)USD along with Morningstar ratings & research, long term fund performance and charts. Does Franklin Income Fund Class C pay dividends? Yes, FCISX has paid a dividend within the past 12 months. · How much is Franklin Income Fund Class C's dividend? The Fund aims to maximise income while maintaining prospects for capital appreciation by investing primarily in equity securities and long & short-term debt. The Franklin Income Fund is balanced between stocks and fixed income and falls into Morningstar's Allocation – 30 percent to 50 percent equity category. Find latest pricing, performance, portfolio and fund documents for Franklin Income Fund - FCISX.

Find latest pricing, performance, portfolio and fund documents for Franklin Income Fund - LU Franklin Income Fund invests principally in equity securities of companies from a variety of industries, stocks with attractive dividend yields, long and short-. Morningstar Category: Funds in allocation categories seek to provide both income and capital appreciation by primarily investing in multiple asset classes. Franklin Income Fund Class C · Price (USD) · Today's Change / % · 1 Year change+%. The Fund seeks to maximize income while maintaining prospects for capital appreciation. The Fund will achieve this by investing in a diversified portfolio of. The fund was incepted in August and is managed by Franklin Advisers. The objective of this fund is to maximize income while maintaining prospects for. Find latest pricing, performance, portfolio and fund documents for Franklin Equity Income Fund - FRETX. Franklin Income Fund Class C (FCISX) ; Risk Rating ; Issuer Franklin Templeton Investments ; Turnover % ; Min. Investment 1, ; 1-Year Change %. The fund was incepted in August and is managed by Franklin Advisers. The objective of this fund is to maximize income while maintaining prospects for. FCISX Performance - Review the performance history of the Franklin Income C fund to see it's current status, yearly returns, and dividend history. Class A Annual Total Returns ; Franklin Income Fund - Advisor Class, %, % ; S&P ® Index (index reflects no deduction for fees, expenses or taxes), -. Franklin Income Fund Class C Data delayed at least 15 minutes, as of Aug 22 Use our fund screener to discover other asset types. Franklin Income Fund Class C · Price (USD) · Today's Change / % · 1 Year change+%. Franklin Income Fund ; Historical Morningstar Ratings. As of 07/31/ ; Years, 3 ; Years, 5 ; Years, 10 ; Summary of Fund Objective. The Fund aims to maximise. The Fund aims to maximise income while maintaining prospects for capital appreciation by investing primarily in equity securities and long & short-term debt. Objective. The investment seeks to maximize income while maintaining prospects for capital appreciation. The fund invests in a diversified portfolio of debt and. Does Franklin Income Fund Class C pay dividends? Yes, FCISX has paid a dividend within the past 12 months. · How much is Franklin Income Fund Class C's dividend? FRANKLIN INCOME FUND CLASS C- Performance charts including intraday, historical charts and prices and keydata. Franklin Income Fund Class C FCISX ; NAV, Change, Net Expense Ratio ; $, 0 (%), % ; Quote data as of close 08/21/

How To Tell If A Phone Number Has Been Ported

Callers can use the database to determine whether a telephone number may have been reassigned so they can avoid calling consumers who do not want to receive the. - Enter the phone number you wish to transfer and click "Check" - If Even after your number has been successfully ported to Tello, it may take up. Call your home number, then call from your home phone to your cell. now logon to your "My Ooma" webpage and look at the call logs. if your calls are listed, at. Porting a number allows your phone number to be transferred from one wireless carrier to another. It is also known as a local routing number, or LRN. When you. Contact your telecommunication provider and find out if your number has been ported to another provider or if there has been a fraudulent SIM Swap. If the. Number porting is the process of taking an existing phone number and transferring it to another provider. Signs to look out for · Unexpected text messages from your mobile service provider advising that “you” have requested your number be ported to a different. Most providers have a pool of phone numbers available for purchase and immediate use from an online administrative portal. In this case, you should notify. Here's How Number Porting Works Let's say you've been a Verizon subscriber for a long time, and you have a current, active phone number which you purchased. Callers can use the database to determine whether a telephone number may have been reassigned so they can avoid calling consumers who do not want to receive the. - Enter the phone number you wish to transfer and click "Check" - If Even after your number has been successfully ported to Tello, it may take up. Call your home number, then call from your home phone to your cell. now logon to your "My Ooma" webpage and look at the call logs. if your calls are listed, at. Porting a number allows your phone number to be transferred from one wireless carrier to another. It is also known as a local routing number, or LRN. When you. Contact your telecommunication provider and find out if your number has been ported to another provider or if there has been a fraudulent SIM Swap. If the. Number porting is the process of taking an existing phone number and transferring it to another provider. Signs to look out for · Unexpected text messages from your mobile service provider advising that “you” have requested your number be ported to a different. Most providers have a pool of phone numbers available for purchase and immediate use from an online administrative portal. In this case, you should notify. Here's How Number Porting Works Let's say you've been a Verizon subscriber for a long time, and you have a current, active phone number which you purchased.

Reminder: Do not cancel your wireless account until your T-Mobile account has been activated. First check to see if your existing number is eligible for. Guide to Transferring (Porting) a Number to magicJack. Can I transfer or “port” my current telephone number to magicJack? Same goes for using your existing phone number and porting it over to another carrier. Check to see if your phone and/or phone number is compatible with Verizon. That means they could reject your port request for even the tiniest inconsistency, so it's a good idea to double-and-triple check everything. When your port. You can check whether your phone number can be ported by visiting gulfstream-fish.ru They all tend to work at different speeds, have different policies and don't always play together nicely. It's our goal to get your number ported ASAP, even if. Track the porting progress Under the “Account” section, click Track your progress. If account information is verified successfully, it shows the estimated. They all tend to work at different speeds, have different policies and don't always play together nicely. It's our goal to get your number ported ASAP, even if. Click the Ported tab. Note: You can only see the porting status of numbers in US and Canada. View reserved phone numbers. If you ported phone numbers. If only keeping your existing number within the same network had been as have ported across back to EE and my phone settings has picked it up. No. Waiting to receive your phone? · You'll get a temporary number until the port request has been completed. · We'll send you an SMS once the port request has been. A phone port can be initiated by providing the genuine owner's name, mobile number, email, or date of birth. If your phone number has been illegally ported, you. You can check your number's eligibility during the order placement process. Most numbers are able to be ported; however, there are a variety of factors that can. RingCentral will email when the requested date has been confirmed. You may also check the confirmed date in the portal in the Number Transfer tab under Phone. Our phone validation service will first perform a phone provider lookup, then ping the carrier's network to determine if the customer or lead's number is. When you make a call, what number shows on the recipient's phone? What number shows in your phone's settings? Always worth a check, but you may be. Tell friends and family members that your phone has been hacked and to be aware of any messages or calls claiming to come from you. Change your security. Check if your number is portable · Notify your current service provider · Pay any porting fees that may be required · Initiate the transfer process · Confirm the. These files only identify numbers that have been ported – you will also need the. IMS' Wireless Block Identifier® file which identifies blocks of telephone.

Mro Stock Buy Or Sell

In the current month, MRO has received 7 Buy Ratings, 0 Hold Ratings, and 1 Sell Ratings. MRO average Analyst price target in the past 3 months is p. Barchart Opinion ; Long Term Indicators ; Day Moving Average, Sell, Weak, Weakening ; Day Moving Average, Buy, Soft, Strengthening. The consensus among 15 Wall Street analysts covering (NYSE: MRO) stock is to Buy MRO stock. Out of 15 analysts, 7 (%) are recommending MRO as a Strong Buy. Projected Stock Price. $ ↑%. Estimated share price Analysts typically set price targets that correspond to their buy or sell recommendations. Sell. Related Research Reports of results. Report Name The average BUY-rated stock dropped 11%, while the average HOLD-rated stock fell 17%. mro stock buy or sell,“Pollution doesn't respect state boundaries,” said Patrick A. Parenteau, a professor of environmental law at Vermont Law. Should I buy Marathon Oil (MRO)? Use the Zacks Rank and Style Scores to find out is MRO is right for your portfolio. See MRO stock price and Buy/Sell Marathon Oil. Discuss news and analysts' price predictions with the investor community. View Marathon Oil Corporation MRO stock quote prices, financial information, real-time forecasts, and company news from CNN. In the current month, MRO has received 7 Buy Ratings, 0 Hold Ratings, and 1 Sell Ratings. MRO average Analyst price target in the past 3 months is p. Barchart Opinion ; Long Term Indicators ; Day Moving Average, Sell, Weak, Weakening ; Day Moving Average, Buy, Soft, Strengthening. The consensus among 15 Wall Street analysts covering (NYSE: MRO) stock is to Buy MRO stock. Out of 15 analysts, 7 (%) are recommending MRO as a Strong Buy. Projected Stock Price. $ ↑%. Estimated share price Analysts typically set price targets that correspond to their buy or sell recommendations. Sell. Related Research Reports of results. Report Name The average BUY-rated stock dropped 11%, while the average HOLD-rated stock fell 17%. mro stock buy or sell,“Pollution doesn't respect state boundaries,” said Patrick A. Parenteau, a professor of environmental law at Vermont Law. Should I buy Marathon Oil (MRO)? Use the Zacks Rank and Style Scores to find out is MRO is right for your portfolio. See MRO stock price and Buy/Sell Marathon Oil. Discuss news and analysts' price predictions with the investor community. View Marathon Oil Corporation MRO stock quote prices, financial information, real-time forecasts, and company news from CNN.

Good Buy or Goodbye? ETF Report · Financial Freestyle · Capitol Gains · Living Not Sell. Analyst Price Targets. Average. Current. MRO stock price is and Marathon Oil day simple moving average is , creating a Buy signal. MRO Technical Analysis vs Fundamental Analysis. Sell. To decide if Marathon Oil Corp stock is a buy or sell, you'll want to evaluate its fair market price or intrinsic value. Buying stocks that are going to go up. Average price target from 22 ratings: $ Average score: Sell. Under. Hold. Over. Buy. Full Ratings · StockGrader. Rating: HOLD. Upgraded from SELL on. Marathon Oil currently has an average brokerage recommendation (ABR) of on a scale of 1 to 5 (Strong Buy to Strong Sell), calculated based on the actual. THE STOCK IS % AWAY FROM ALL-TIME HIGHS OF $ MRO IS UP 16% SINCE THE BEGINNING OF THE YEAR. MRO IS UP 9% OVER THE PAST 12 MONTHS. MRO is trading within a range we consider fairly valued. Price. $ Aug 29, 3 Top Oil Stocks to Buy in May. Matt DiLallo | May 3, These oil companies have nearly unlimited upside to higher oil prices. What Stock Market Sell-Off? Marathon Oil (NYSE:MRO) Stock, Analyst Ratings, Price Targets, Forecasts Marathon Oil Corp has a consensus price target of $ based on the ratings of In the last year, 1 stock analyst published opinions about MRO-N. 1 analyst recommended to BUY the stock. 0 analysts recommended to SELL the stock. The latest. The current Marathon Oil [MRO] share price is $ The Score for MRO is 55, which is 10% above its historic median score of 50, and infers lower risk than. Stock Price Targets. High, $ Median, $ Low, $ Average, $ Current Price, $ Yearly Numbers. Estimates. MRO will report earnings. 18 Wall Street equities research analysts have issued "buy," "hold," and "sell" ratings for Marathon Oil in the last twelve months. There are currently 8 hold. Devin McDermott, a top 3% analyst from Morgan Stanley maintains MRO with a hold rating and raises their MRO price target from $ to $, on Apr 15, Price Target. $ (% upside). Analyst Consensus: Buy. Created with Highcharts Strong Sell Sell Hold Buy Strong Buy 0 5 Stock Forecasts. Analyst Ratings. The average analyst rating for Marathon Oil stock from 17 stock analysts is "Buy". This means that analysts believe this stock is likely to. Is Marathon Oil Corporation (MRO) a buy, sell, or hold? 22 analysts have Should I buy MRO or CTRA stock? MRO's Wall Street analysts's rating. Assess the Marathon Oil stock price estimates. View analyst opinion as to whether the stock is a strong buy, strong sell or hold, based on analyst Month MRO. Analyst Ratings. Sell; Under; Hold; Over; Buy. Number of Ratings 22 Full Ratings. Recent News. MarketWatch. Dow Jones. Read full story · Marathon Oil Corp. Get Marathon Oil Corp (MRO:NYSE) real-time stock quotes, news, price and financial information from CNBC selling or sharing/processing data such as your name.